Respond To Business Risks In Real-Time With Integrated Risk Management

Responding In Real-Time Reduces Risk

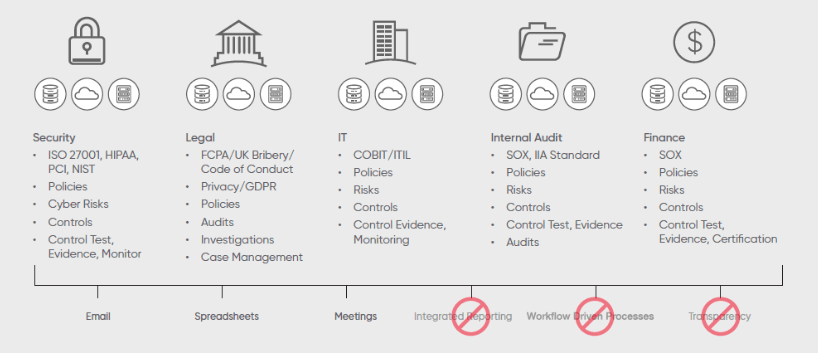

Existing GRC Processes and Common Challenges

Risk and compliance groups are at their limits with the barrage of regulations, new compliance guidelines, and internal risk reduction initiatives. New Governance, Risk, and Compliance (GRC) programs are able to scale to meet this demand while supporting visibility and reporting needs ensuring enterprises are meeting compliance mandates and addressing risks.

Common Risk Issues

Those that don’t have these programs in place are most likely (putting their businesses at risk and peril) have analysts and managers generally relying on email, spreadsheets, and meetings to get work done. They do not realize or aren’t sure how many repeatable processes exist which can be easily automated within departments or even across departments.

It’s an inefficient process where collaboration typically happens outside the systems enterprises depend on and work with. These systems do not provide important integrated reporting, processes, and transparency across functional groups. In these scenarios, it is easy to see why enterprises struggle to meet compliance mandates.

Optimize Internal Audit Productivity

Use of risk data and issues management enables effective audit project scoping, planning, and reporting while optimizing internal audit and compliance resources.

Top 3 Challenges

- Reactive Responses – Organizations that are only able to be reactive in responding to tackling regulatory risks and requirements are missing high-impact or emerging risks that are better served when organizations are proactively monitoring critical controls.

- Too Many Silos – With no cross-functional process integration or way to prioritize critical risks, introducing multiple functional silos with redundant processes and disparate systems renders processes inefficient and prone to breaking down. This impacts businesses with loss events and unnecessary risk.

- Manual Processes – meetings, phone calls, spreadsheets, email and other fragmented tools are not efficient and introduce substantial risk if they are the foundation of a risk management program. Analysts are stymied by manual, antiquated, and inconsistent processes such as these and they don’t scale.

What to do if this sounds like your organization

You need an automated Governance, Risk, and Compliance (GRC) solution which will help transform inefficient processes across your extended enterprise into an actionable, automated, and integrated risk program while connecting the business, security, and IT with an integrated risk framework.

Continuous monitoring and automation can improve decision making, allow you to respond to business risks in real-time and increase performance across your organization and with vendors.

Benefits of Integrated Risk Management Framework

- Transforms manual, siloed, and inefficient processes into a unified program.

- Get actionable information from real-time dashboards through continuously monitor your risks

- Identify your most critical risks and more effectively communicate with other departments, vendors, executives, and board. And provide the necessary contextual information to make decisions (assess business impact and prioritize activities)

- Automate and be more efficient with cross-functional response activities, evidence data collection, repetitive processes, and reporting

- Free analysts up to work on high-value tasks vs hiring more people. Remediation time from weeks to only minutes.